| POS equipment | Credit card reader, receipt printer, cash drawer, barcode scanner, physical inventory scanner, tag printer, PIN pad, pole display |

| Payment methods accepted | Credit and debit cards, Apple Pay, PayPal, Venmo, ACH, bank transfers |

| Payout times | Next day as standard, instant payout to QuickBooks Checking account |

| Contract length | Monthly (no cancellation fees) |

| Customer support | Phone and live chat support Monday to Friday, 5 a.m. – 6 p.m. PST, an online community, video tutorials, a resource center with articles |

| Security | PCI compliant, chargeback protection, tokenization, data encryption, multi-factor authentication, two-step authentication |

Great Option for Existing QuickBooks Users

QuickBooks Payments is a comprehensive credit card processing solution that caters to small and medium businesses that already use QuickBooks for accounting. It seamlessly integrates with QuickBooks’ entire software ecosystem, and several happy customers attest to its user-friendly interface.

The onboarding process is also straightforward and includes no setup fees — though you’ll need a QuickBooks Online or QuickBooks Desktop account to sign up for QuickBooks Payments.

What’s more, QuickBooks Payments supports credit and debit cards (including keyed and tapped payments), digital wallets, and ACH bank payments. It also adopts a transparent percentage-based markup pricing model with no monthly fees.

That said, QuickBooks Payments does have some downsides, like its higher-than-usual processing fees and lack of support for high-risk businesses. Top credit card processors like Leaders Merchant Services are much more affordable, offer a high approval rate, and integrate seamlessly with QuickBooks.

Features and Ease of Use

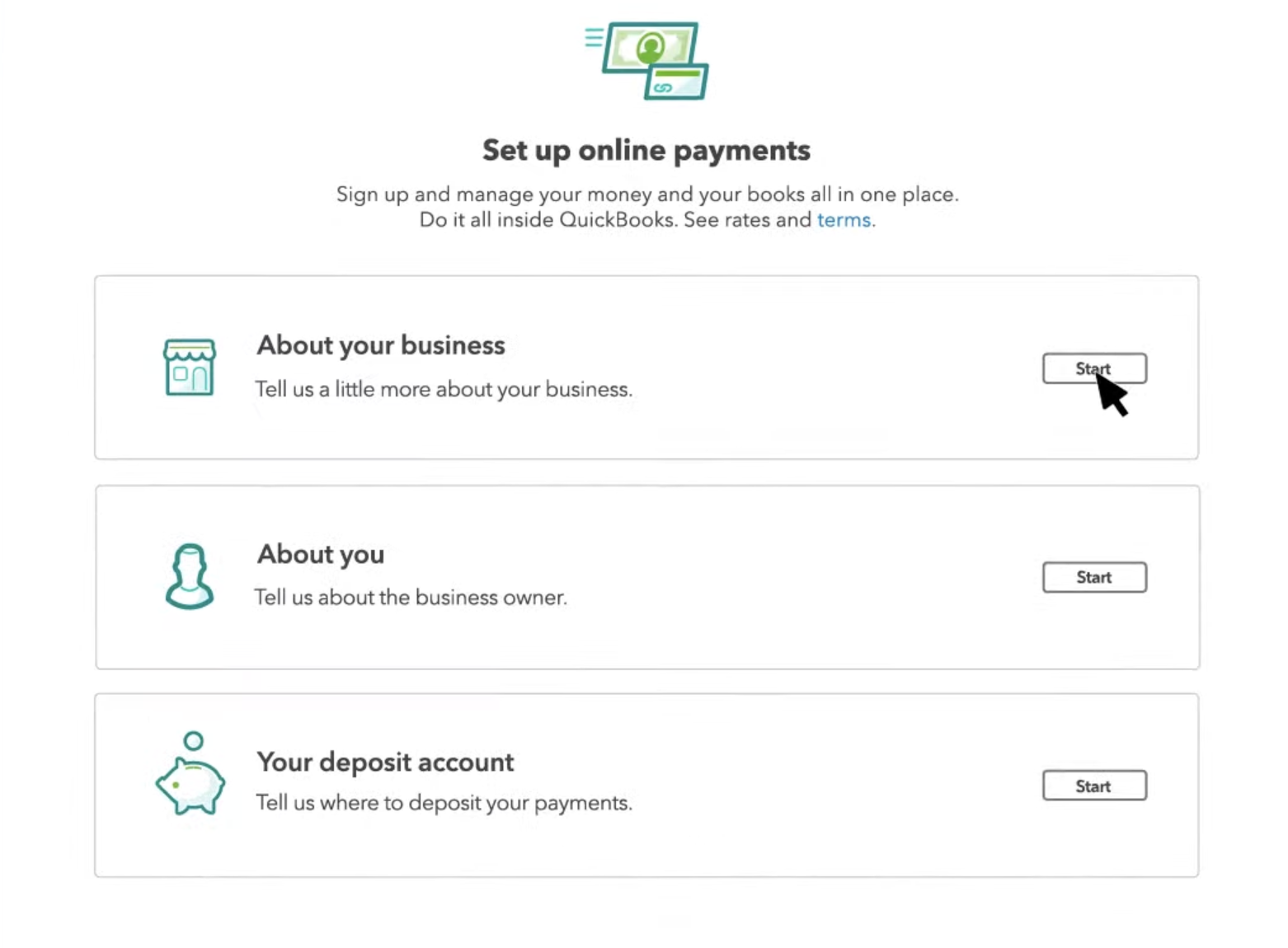

Signing up for an account is very straightforward, and you can do this from within your QuickBooks account. You can create a merchant account in less than 3 minutes and get approved within 1 to 3 days.

Compared to other similar vendors, Intuit QuickBooks Payments offers a more seamless integration with its accounting software, making it a convenient choice for current QuickBooks users. However, businesses not using QuickBooks might find the integration less beneficial.

Impressive POS Solutions

QuickBooks Payments offers a wide variety of Point of Sale (POS) solutions, including 3 different card readers — QuickBooks Card Reader (for EMV chip cards and contactless payments), QuickBooks Chip and Magstripe Card Reader (for EMV chip cards and debit and credit cards with magstripe), and QuickBooks All-in-One Card Reader (for EMV chip cards, debit and credit cards with magstripe, and contactless payments).

All 3 card readers work via Bluetooth with the QuickBooks Online mobile app or QuickBooks GoPayment app, allowing you to process payments on the go.

QuickBooks also offers a receipt printer, a tag printer, a cash drawer, a physical inventory scanner, a bar code scanner, pin pads, and a pole display. Only the Chip and Magstripe Card Reader are free for new customers – all other hardware costs extra.

Other top processors offer more hardware variety with their plans. Stax, for example, integrates with QuickBooks and gives you all the hardware you need based on your business requirements. It is a much better choice for most merchants, especially considering its transparent subscription plan and low transaction fees.

Multiple Payment Methods and Fast Payout Times

QuickBooks Payments accepts various payment methods, including credit and debit cards, ACH bank payments, Apple Pay, PayPal, and Venmo. This versatility ensures your businesses can cover a broad spectrum of customer payment preferences.

QuickBooks also offers next-day deposits as a standard feature, providing timely access to your funds. For an additional 1.75% fee, instant payouts are available. However, instant deposits are available at no extra cost if you have a QuickBooks Checking account.

Access to All of QuickBooks’ Native Tools and Features

Since QuickBooks Payments requires a QuickBooks Online or QuickBooks Desktop account, you automatically gain access to the comprehensive range of tools and features that QuickBooks offers. These include automatic transaction mapping, mileage tracking, bill pay, receipt capture, recurring payments, digital invoicing, and extensive reporting capabilities.

You also get access to QuickBooks Term Loan, a program through which you can apply for loans from $1,500 to $200,000 on 6-24 month terms. The approval process can take as little as a few minutes, and once your loan is approved, you’ll get your funds within 1 to 2 business days.

Pricing and Support

Intuit QuickBooks Payments offers a pay-as-you-go markup pricing model that varies depending on the transaction type. For ACH bank payments, it charges 1%. Card reader transactions for in-person payments are at 2.5%, online transactions at 2.99%, and keyed-in card transactions are priced higher at 3.5%. QuickBooks may offer lower rates if you process more than $2,500 per month, but you’ll have to contact support to determine eligibility.

While QuickBooks Payments doesn’t have a monthly fee, because you need a QuickBooks Online or QuickBooks Desktop account to own a merchant account, you’ll eventually end up paying a monthly fee starting from $15 (QuickBooks offers a 50% discount for the first 3 months, so you’ll end up paying a minimum monthly fee of $30 down the road).

QuickBooks Payments claims it has no hidden fees, but several extra fees are not displayed on its pricing page. These include a $25 chargeback fee, a PCI service fee, a $10 returned check fee, a $25 ACH/electronic bank reject fee, and a possible minimum service monthly fee of $35 when you fail to meet your minimum processing volume.

QuickBooks Payments’ pricing model is beneficial for small to medium-sized businesses that may not have a consistent volume of transactions every month. That said, the service’s rates are much higher than most competitors and are unsuitable for businesses that process high-volume transactions. Stax is a better alternative as its rates start from as low as $99.00.

QuickBooks Payments offers live chat and phone support Monday to Friday from 6 AM to 6 PM PT. QuickBooks users can also access an online community to speak with a support expert or fellow business owners. While this isn’t bad, Leaders Merchant Services offers 24/7 support, so you can speak to customer reps even on weekends.

| Phone | ✔ (Monday to Friday from 6 a.m. to 6 p.m.) |

| ✘ | |

| Live chat | ✔ (Monday to Friday from 6 a.m. to 6 p.m.) |

| Support ticket | ✘ |

| Knowledge base | ✘ |

| Tutorials/videos | ✔ |

| Dedicated account manager | ✘ |

| Other | Blog, community forum |

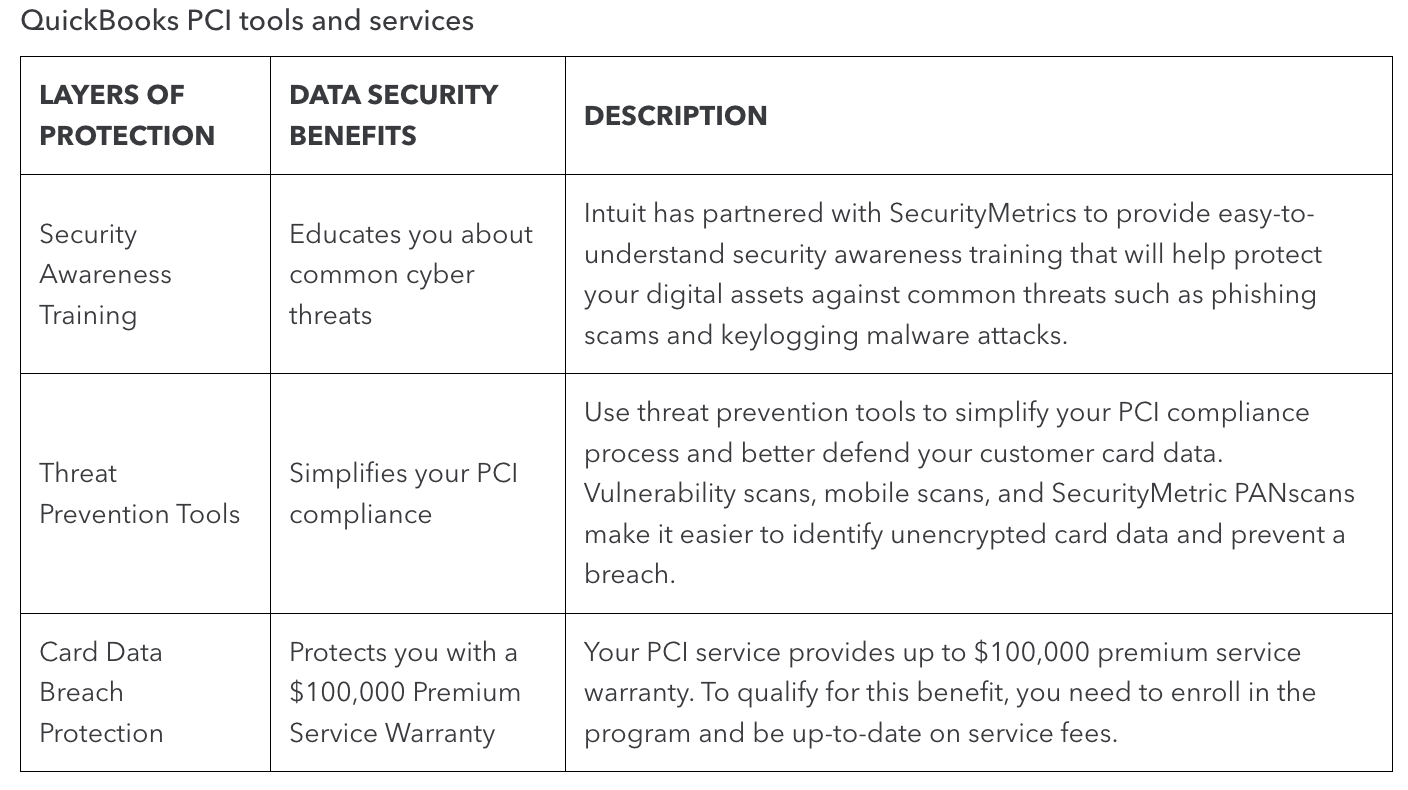

Compliance & Security

While Intuit QuickBooks Payments is PCI compliant, using it doesn’t automatically make your business PCI compliant. Luckily, QuickBooks Payments partnered with SecurityMetrics to help you achieve PCI compliance. It is also SOC 2 and GDPR compliant. Plus, it offers other security features like chargeback protection, data encryption, tokenization, threat prevention tools, breach protection with up to a $100,000 warranty, and multi-factor authentication.

| PCI DSS compliant | Level 1 |

| GDPR compliant | ✔ |

| HIPAA compliant | ✘ |

| Other payment card industry and privacy standard(s) | SOC 2 |

| PCI compliance assistance for merchants | Partnership with SecurityMetrics |

| Security features | Chargeback protection, data encryption, tokenization, breach protection, multi-factor authentication, and two-step authentication |