| POS equipment | Clover terminals, Pax A920, Pax A80, and FD150 to purchase or lease |

| Payment methods accepted | Credit and debit, ACH, EFT, digital wallets, bank transfers, Skrill, Venmo |

| Payout times | 1-2 business days |

| Contract length | Monthly |

| Customer support | 24/7 technical support line for customers; other support available Monday to Friday via phone and email |

| Security | Level 1 PCI-compliant, tokenization, end-to-end encryption, GDPR, and more |

Customized Fees and International Support, but Not Very Transparent

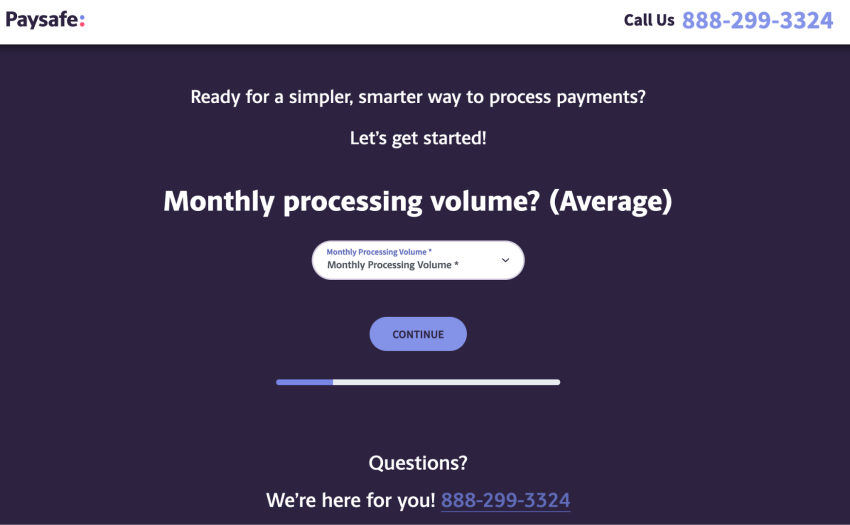

With a focus on simplicity, security, and flexibility, Paysafe aims to provide a reliable and user-friendly payment solution. Though it advertises itself as a great option for businesses of all sizes, we’ve found that Paysafe is best for businesses that sell high ticket items at low volumes.

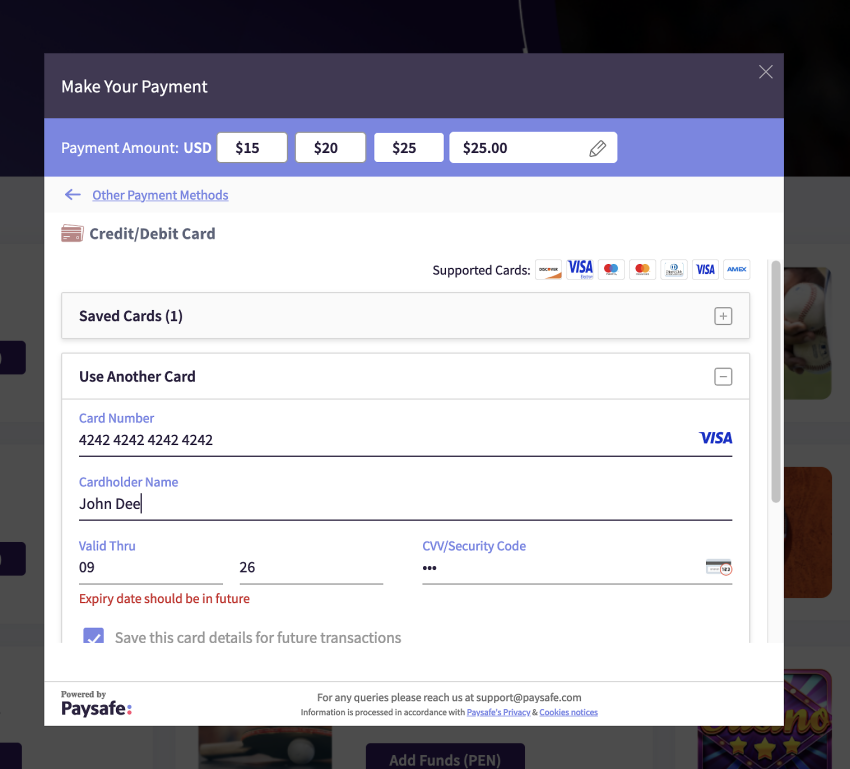

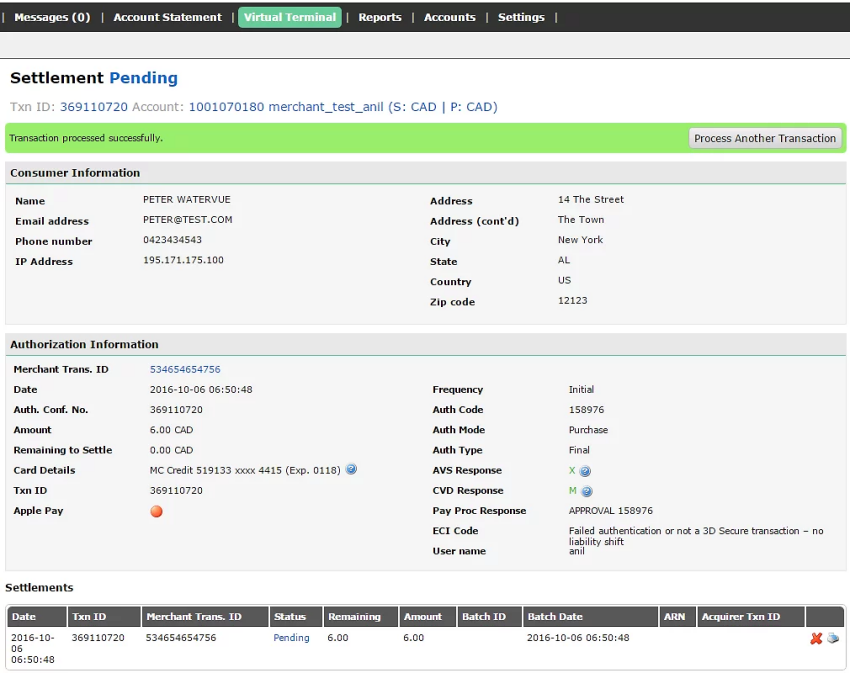

Its offerings include point-of-sale (POS) devices, e-commerce payment gateways, and omnichannel payment solutions, catering to both brick-and-mortar and online businesses. This versatility allows your business to accept payments across multiple channels and reach a broader customer base.

Unlike many other processors, Paysafe is available in multiple regions, including the US, UK, Canada, and Europe, with partners in Latin America as well. This makes it ideal if you operate in multiple countries or are hoping to expand and want to stick to one system.

Despite all these distinctive features, Paysafe has less-than-stellar reviews. After digging deeper into this, I realized that most of the negative reviews are about a separate consumer product: the paysafecard.

Luckily, the credit card processing side of the business is much more positive. In fact, almost every review I read in regard to payment processing only had good things to say, from speedy responses and great account managers to affordable rates and equipment.

However, that’s not to say that Paysafe is the best for every business. Read on to discover if Paysafe is right for yours.