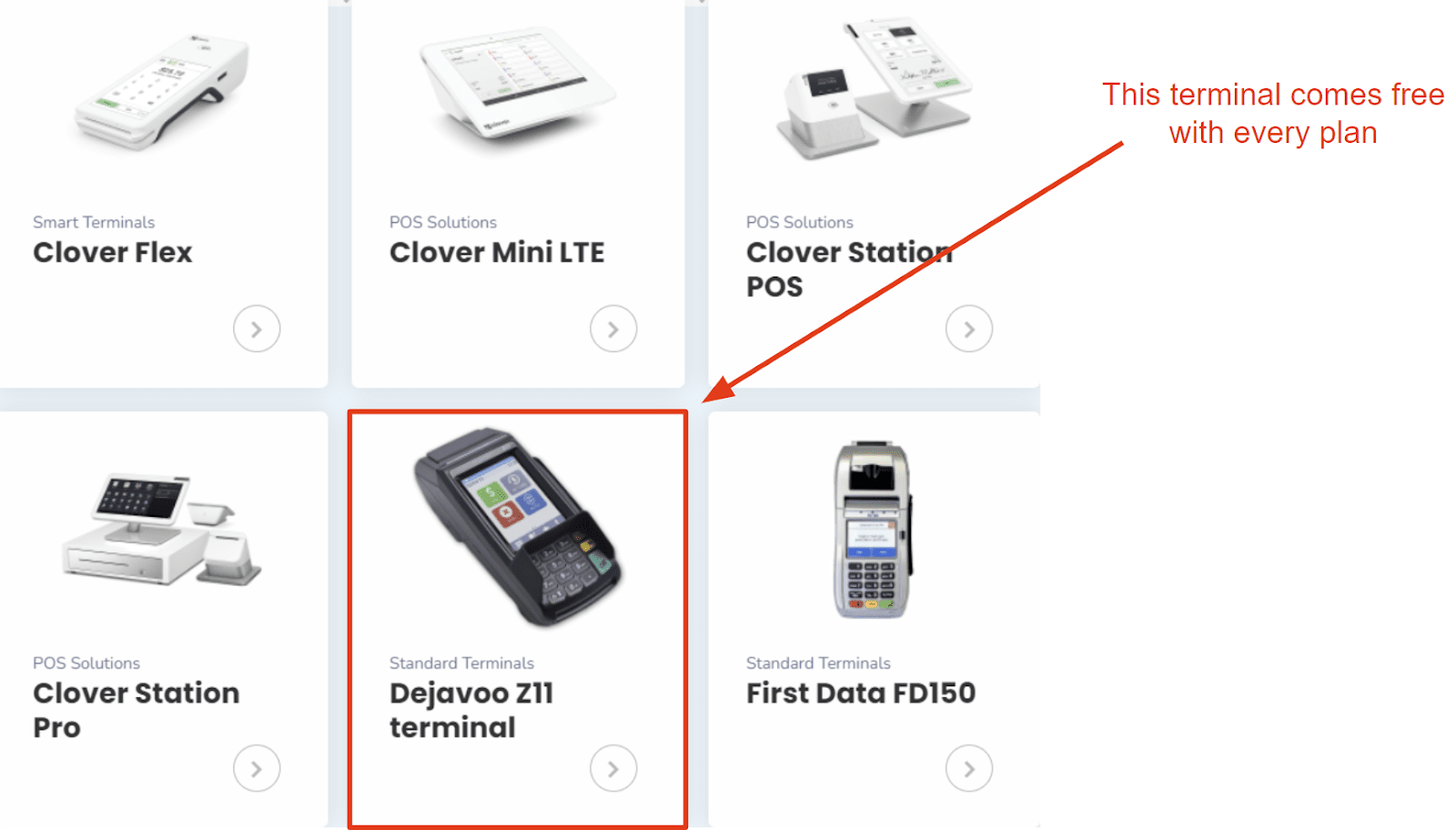

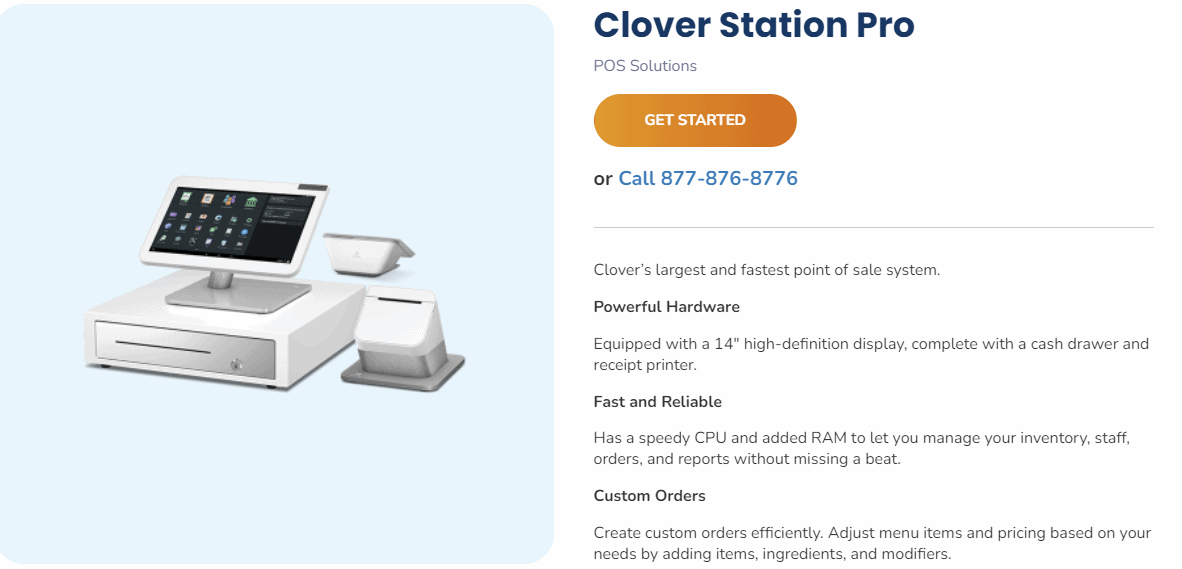

| POS equipment | Free Dejavoo terminal. 2 Dejavoo terminals, 4 Clover devices, and 1 SwipeSimple mobile reader available to purchase |

| Payments methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout times | 24 hours |

| Contract length | Monthly (no cancellation fees) |

| Customer support | 24/7 technical support line via phone and ticket, sales support between 8.30 am – 7.30 pm EST/PST |

| Security | Level 1 PCI-compliant, tokenization, end-to-end encryption, payer authentication, 24/7 fraud risk monitoring |

Cheap and Reliable Payment Processing With Some Support Issues

Payment Depot definitely looks enticing on the surface, so much so that you might think there must be a catch. After all, it promises no markups on transactions – just a simple, flexible, and transparent interchange+ plan with no monthly fees. It positions itself as one of the cheapest options in the industry today, but is that really the case? I decided to take a further look.

Interestingly, Payment Depot is actually a subsidiary of Stax. Unlike its parent company, which primarily caters to high-volume businesses, Payment Depot targets small to medium-sized businesses of any card volume. Only available in the US, it has many options available for both e-commerce and more traditional brick-and-mortar establishments.

A cursory glance at user reviews also paints a promising picture: Payment Depot is well-regarded among merchants, and the number of negative reviews is impressively low. Some of the happiest merchants have worked with Payment Depot for many years and state that it has actually delivered big savings as promised.

With my interest piqued, I compiled thousands of user reviews and performed extensive research, pitting Payment Depot against the top payment processors available today. All in all, Payment Depot mostly lives up to the hype, but it certainly isn’t perfect. Read on to see if Payment Depot is right for your business.