| POS equipment | NIL |

| Payment methods accepted | Credit and debit cards, PayPal, Venmo, Apple Pay, Google Pay, ACH, bank transfers |

| Payout times | 2-5 days |

| Contract length | Monthly (no cancellation fees) |

| Customer support | Support ticket, phone support, a knowledge base |

| Security | Level 1 PCI compliant, advanced fraud protection, tokenization, data encryption, two-factor authentication |

E-commerce Payment Solution With a Poor Track Record

Braintree Payments is both a credit card processor and a payment gateway that caters to businesses of all sizes. Braintree is distinctly tailored to e-commerce businesses, allowing seamless online transactions across 45 countries and with over 130 currencies.

Its pricing model is straightforward, with no monthly fees, minimum monthly transaction requirements, and a transparent transaction markup. However, Braintree is not without its flaws. For one thing, it’s less suited for businesses with many brick-and-mortar operations.

And while some users have praised its intuitive interface, others have criticized Braintree for its poor customer support, weak fraud protection, and chargeback fees. Compare that to our top payment processor: Leaders Merchant Services has a dedicated chargeback team, plus 24/7 customer support and advanced fraud detection tools.

While Braintree is primarily suited for online ventures, most e-commerce business owners may be better off using any of our recommended credit card processors in 2025. That said, you should still read on to determine if Braintree suits you and your specific needs.

Features and Ease of Use

Braintree Payments has garnered many complaints regarding its setup process. It contrasts with our other top payment processors, which devote much more time to the initial merchant setup. For example, LMS’ onboarding takes just a day and involves more customer support.

While Braintree’s setup is said to be difficult, most users speak highly of its day-to-day user interface. Braintree also integrates with several e-commerce and business tools but doesn’t offer POS equipment for brick-and-mortar businesses.

Customizable Checkout Experience

There are two ways to incorporate Braintree into your site or app, and both involve copying and pasting a few lines of code. The first is the Drop-in method. With this, you just paste some code and get a full checkout flow within minutes. You can do some basic customization, and it’s easy to match the checkout process to your app or site’s color scheme.

Alternatively, there’s the second method: custom integration. This gives you much more control over your checkout process but involves more work with the code and is better for advanced users. That said, custom integration gives you a unique chance to tailor your checkout pages while maintaining full PCI compliance.

Multiple Payment Methods & Currencies

Braintree enables your business to accept various payment methods, including credit/debit cards, PayPal, Venmo (in the US), Apple Pay, and Google Pay. It also accepts 130+ currencies and processes transactions across 45 countries, allowing you to scale internationally and reach a global audience.

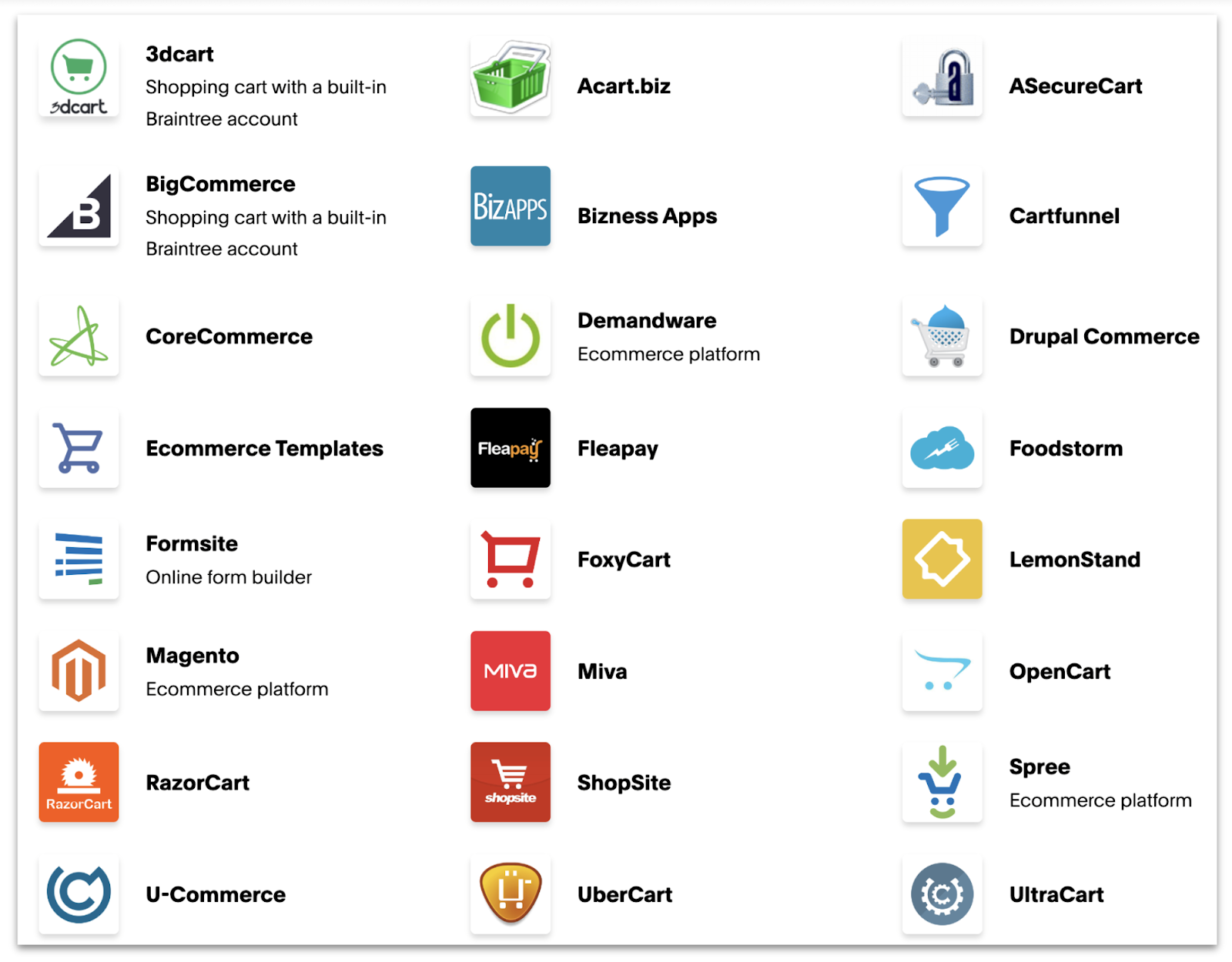

Extensive Third-Party Integrations

Braintree seamlessly connects with leading e-commerce platforms, shopping carts, analytics services, accounting software, and billing applications. This allows your business to maintain its operational flow while incorporating Braintree’s payment solutions. These integrations include BigCommerce, WooCommerce, Invoiced, Barametrics, Zapier, and many more.

Pricing and Support

Braintree uses a flat-rate pricing model with a standard transaction fee of 0.75% (ACH Direct Debit) for ACH Direct Debit and 2.59% + 0.49¢ (cards and digital wallets) for cards and digital wallet transactions. For transactions using Venmo, fees increase to 3.49% + 0.49¢ (Venmo). There are no monthly fees, setup fees, or minimum transaction fees. If your business processes over $80,000 a month, you can contact Braintree’s sales team for a custom flat rate or interchange-plus pricing.

As with most payment processors, Braintree has additional fees, such as a $15 chargeback fee. Payments made with non-USD currencies incur an extra 1% fee, plus another 1% if the card is issued outside the United States.

While Braintree’s pricing model is straightforward and tailored to accommodate various business needs, I’d only recommend it to small to medium-sized enterprises (SMEs). E-commerce stores that process high-volume transactions monthly are better off using Stax, as its transaction fees go as low as $99.00.

But even then, if you own an SME, you can still find lower rates with Leaders Merchant Services and other leading processors. Not only does LMS offer competitive rates, but it also allows you to negotiate prices that suit your business needs.

Braintree has phone support, a support ticket system, and a comprehensive knowledge base of support articles and tutorials. The support articles include an extensive set of documentation for developers. It’s an excellent resource if you or someone on your team has technical experience, and customizing your site’s code is an option.

I’ve found Braintree’s customer service representatives adequate, but I was experiencing the sales side, not the day-to-day technical support side. Braintree’s customer support has many negative reviews, which is a serious issue.

| Phone | ✔ |

| ✔ | |

| Live chat | ✘ |

| Support ticket | ✔ |

| Knowledge base | ✔ |

| Tutorials/videos | ✔ |

| Dedicated account manager | ✘ |

| Other | ✘ |

Compliance & Security

Braintree Payments is level 1 PCI compliant, but integrating with the service doesn’t automatically make you PCI compliant. To help you with that, Braintree partners with SecurityMetrics, a PCI compliance assessor firm. Once your Braintree account is approved, you’ll get an email detailing how to create your account with SecurityMetrics.

Otherwise, Braintree offers tokenization, data encryption, and two-factor authentication. It also has solid anti-fraud tools, like 3D Secure authentication, and you can upgrade to a more advanced fraud prevention package.

| PCI DSS compliant | Level 1 |

| GDPR compliant | ✘ |

| HIPAA compliant | ✘ |

| Other payment card industry and privacy standard(s) | ✘ |

| PCI compliance assistance for merchants | ✔ |

| Security features | Advanced fraud protection, tokenization, data encryption, two-factor authentication |