Inside this Article

A Quick Note on Stripe’s Pricing Structure

Stripe offers two pricing structures – a basic flat fee and a customized plan. The flat fee structure is available to most Stripe customers, while the custom plan is reserved for large businesses. Stripe doesn’t give any criteria for what it considers a “large enough” business, unfortunately. While I’ve included a section below on fees that apply specifically to merchants paying for a custom plan, everything else refers to the flat-fee structure plan.Stripe’s Core Transaction Fees

Stripe uses a flat rate fee structure with no monthly fees or setup costs. You’ll also pay for every additional feature you use on a per-transaction basis (i.e., you’ll effectively pay for payment processing on a pay-as-you-go basis). This fee structure includes a long list of core features at no extra cost, so it’s easy to see why Stripe is such a popular choice for small businesses on a limited budget.

| Payment Method | Fee |

| Card-present payments | 2.7% + 5¢ |

| Tap to Pay (in-person contactless) payments | Additional 10¢ |

| Card-not-present payments | 2.9% + 30¢ |

| Keyed-in payments | Additional 0.5% |

| International payment card | Between 80¢ and 2.95% + 30¢ depending on card type, plus additional 1.5% |

| Payments in currency other than $USD | Additional 1% |

| Adaptive Acceptance | Additional 0.08% per successful card charge |

| ACH Direct Debit | 0.8%, capped at $5, plus an additional $1.50 per instant bank account validation |

| ACH Credit | $1 per transaction |

| Wire transfer | $8 per transfer |

| Checks | $5 per check |

| Issue | Fee |

| Failed ACH Direct Debit payment | $4 per failure |

| ACH Direct Debit dispute | $15 per dispute (refunded if successful) |

| Chargeback | $15 per dispute (refunded if successful) |

| Bounced cheque | $15 per cheque |

Additional Stripe Fees

Most businesses will need more solutions than just payment processing, and Stripe charges additional fees to cover these. Some services are included, such as an automatic card updater and 3D Secure authentication for online purchases. However, other nice-to-haves come at a premium rate.Faster Payouts

You’ll receive Stripe payouts on a 2-day rolling basis, or you can choose to receive your money weekly or monthly. High-risk businesses will have to wait longer with a 14-day payout speed. All payment processors charge extra for faster payouts, and Stripe is no exception.| Service | Fee |

| Instant payout (within 30 minutes) | 1% of payout total, minimum fee of 50¢ |

| ACH Direct Debit two-day settlement | 1.2% |

Buy-Now-Pay-Later (BNPL)

Stripe is one of the few payment processors that offer buy-now-pay-later (BNPL) services, like Klarna, Afterpay, and Affirm. These services are becoming increasingly popular but also have incredibly high fees.| Service | Fee Per Payment |

| Affirm (Pay in 4 & Instalments) | 6% + 30¢ |

| Afterpay (Pay in 3 or 4) | 6% + 30¢ |

| Klarna (Pay in 4) | 5.99% + 30¢ |

| Klarna (Financing) | 2.99% + 30¢ |

Invoicing

| Service | Fee |

| Stripe Invoicing (Starter) | 0.4% per paid invoice |

| Stripe Invoicing (Plus) | 0.5% per paid invoice |

| Post-payment invoices | 0.4% per invoice, capped at $2 |

Stripe Billing

| Service | Fee |

| Stripe Billing (Starter) | 0.5% per recurring payment |

| Stripe Billing (Scale) | 0.8% per recurring payment |

Stripe Tax

Stripe Tax automatically calculates and collects sales tax, VAT, and goods and services tax due on each sale. This works for both US and international taxes. It also automates your tax filing by generating tax reports you can easily export.| Service | Fee |

| Stripe Tax (<$100,000/month transaction volume) | 0.5% per transaction in registered locations |

| Stripe Tax (>$100,000/month transaction volume) | 0.4% per transaction in registered locations |

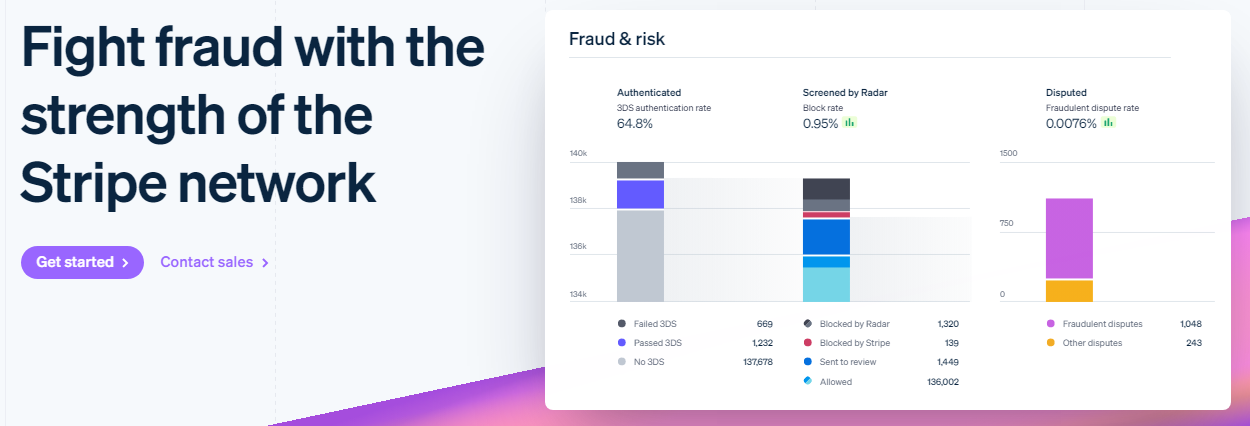

Security

| Service | Fee |

| Point-to-point encryption | 5¢ per authorization |

| Stripe Radar for Fraud Teams | 2¢ per screened transaction |

| ID document and selfie verification | $1.50 per verification |

| ID number lookup | 50¢ per lookup |

| Chargeback protection | 0.4% per transaction |

Financial Connections

| Service | Fee |

| Instant bank account verifications | $1.50 per successful verification (verification via micro-deposits is free) |

| Account balance retrieval | 10¢ per successful API call |

| Verify bank account owners | $1.50 per successful verification |

| Account transaction feed | 30¢ per institution per account holder per month |

Custom Plan Fees

Finally, it’s worth noting that merchants on custom plans will pay different rates for certain features. While the custom plan offers different per-transaction pricing for payment processing, some additional fees are standardized. Curiously, you’ll have to pay for features that are included for free in the standard plan, such as 3D secure authentication and Stripe Radar.| Service | Fee |

| 3D Secure authentication | 3¢ per attempt |

| Card account updater | 25¢ per update |

| Stripe Radar | 5¢ per screened transaction |

| Stripe Radar for Fraud Teams | 7¢ per screened transaction |

Additional Stripe Features and Fees

Stripe offers far more features (and associated fees) than I have space for here. These include custom domain names for payment pages, automated accounting services, custom data reporting, card issuing, and more. As with most of Stripe’s features, these are optional, but they do make Stripe increasingly unaffordable if those features are necessary for your business.Why We Don’t Recommend Stripe’s Flat-Rate Pricing

According to a study conducted by S&P Global, more than half of consumers use their debit card as their primary payment method – and the higher a consumer’s household income, the more likely they were to use their debit card over a credit card. Debit cards have a significantly lower wholesale interchange rate (the rate charged by card networks) than the flat rate charged by Stripe. With that in mind, using Stripe’s flat-rate pricing doesn’t make sense unless you have no other option. You’ll end up paying a significantly higher markup on the majority of the cards that you accept. The only exception is if the bulk of your sales come from premium credit cards with a higher wholesale rate than the charged flat rate. Don’t get me wrong – I don’t think that flat-rate pricing is completely pointless, nor that Stripe has nothing to offer. However, in this case, the biggest benefit of flat-rate pricing comes from Stripe itself. Stripe’s lack of monthly fees, transparent pricing, and a “most features are optional” pricing structure is why it’s a good choice for limited-budget businesses, not the flat-rate pricing model. It’s also convenient for new businesses because they can set up their merchant account without underwriting.

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

The Best Stripe Alternatives

Given that few businesses can benefit from Stripe’s pricing model, I recommend the following alternatives.

Leaders Merchant Services: Best for Budget-Conscious Businesses

Free Card Reader

Our Score

Our Score

Best Credit Card Processor in 2025

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Stax: Best for High-Volume Businesses

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Payment Depot: Best for Mid-Sized Businesses

Our Score

Our Score

Excellent Customer Service Backed by a Dedicated Risk Monitoring Team

Monthly Fee:

From $79

Transaction Fee:

From 0% + 10¢

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

| Stripe | Leaders Merchant Services | Stax | Payment Depot | |

| Card-present transaction fee | 2.7% + 5¢ | ~0.15% + $0 | 8¢ + interchange (in-person) | 0.2%-1.95% |

| Card-not-present transaction fee | 2.9% + 30¢ | ~2.9% + 30¢ | 15¢ + interchange (online) | 0.2%-1.95% |

| Monthly fees | None | $9.00 | $99.00 | $0 |

| Software fees | Variable | From $25/month | No additional fees | No additional fees |

| Ideal for | Small, low-volume businesses | Budget-conscious businesses | High-volume businesses | Mid-sized businesses |