Inside this Article

Features

Stax Powers Every Part of Your Business

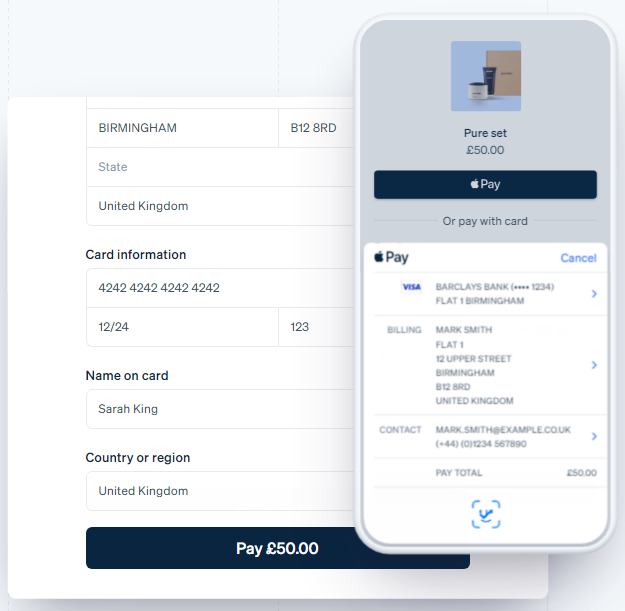

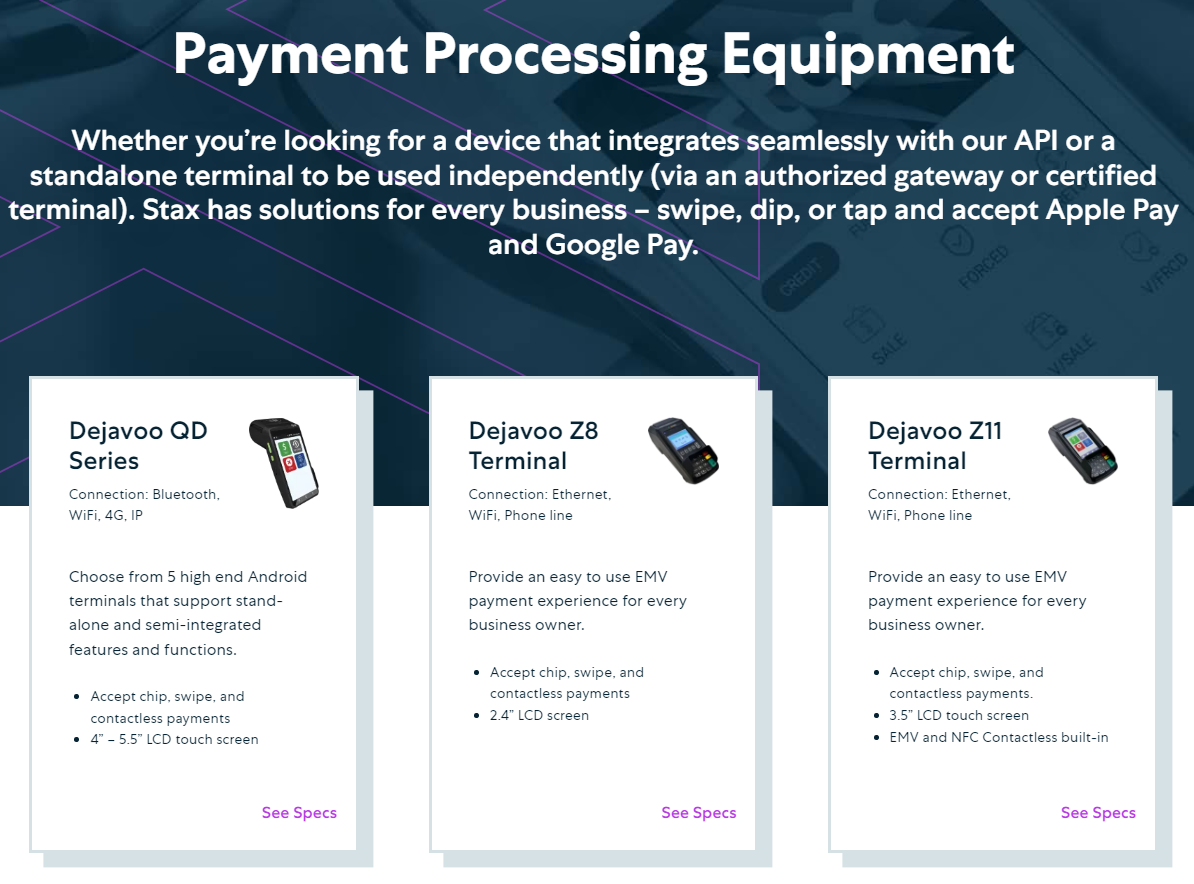

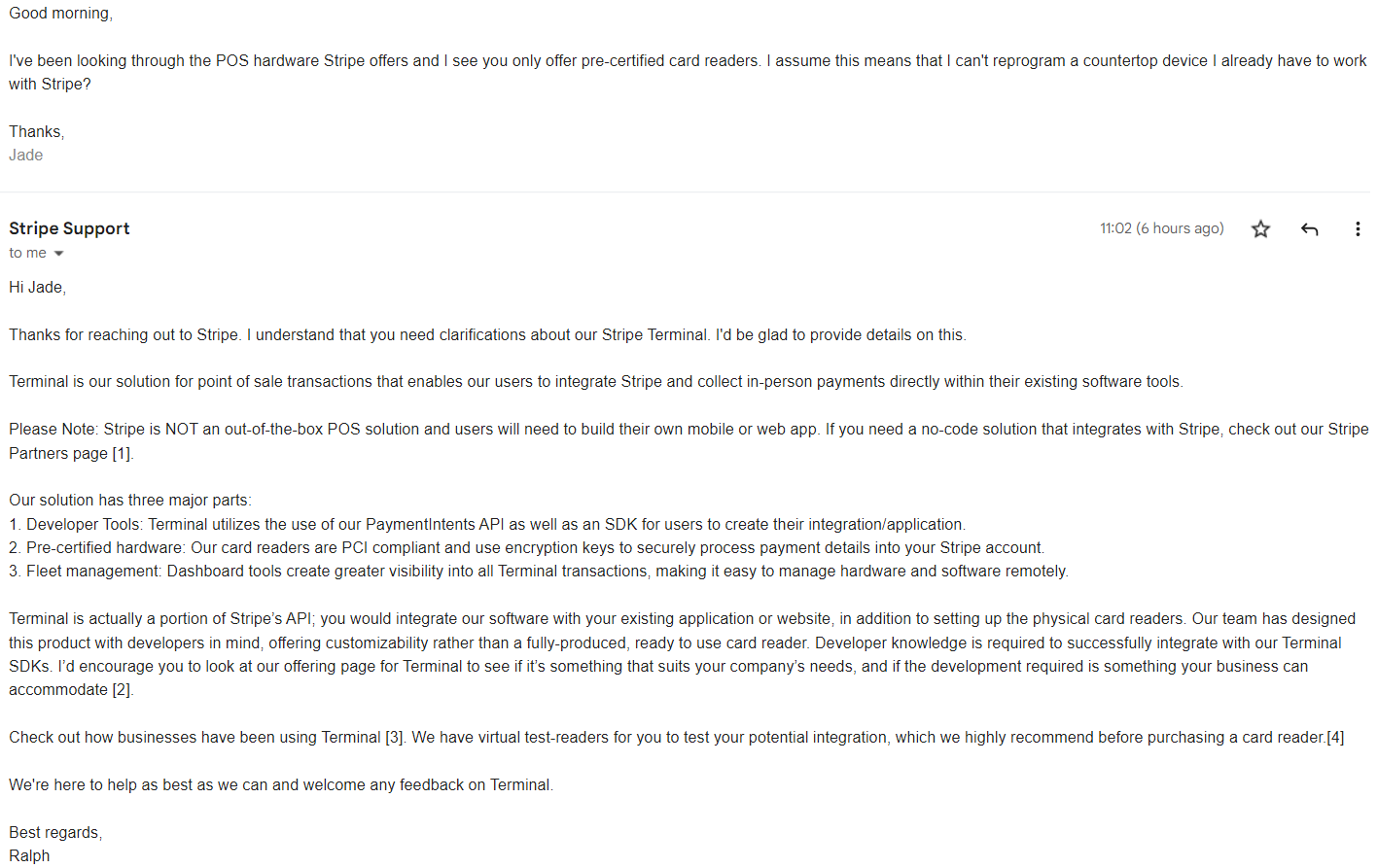

On the surface, both Stax and Stripe look like great options for businesses that operate both online and in-person. Dig a little deeper, however, and you’ll find that Stax’s feature set is more comprehensive. On top of some of the best payment software on the market, Stax offers far more POS features than Stripe. All in all, Stax gives you more useful functionality for both taking payments and growing your business. The key thing to remember is that Stripe was designed primarily for online payments. It offers pre-built shopping carts, checkout pages, a payment gateway, and hundreds of software integrations. Stripe even allows you to accept payments in 135+ currencies, while Stax only processes payments in USD.

Ease of Use

Slower Setup and Payout Times, But Stax is Worth the Wait

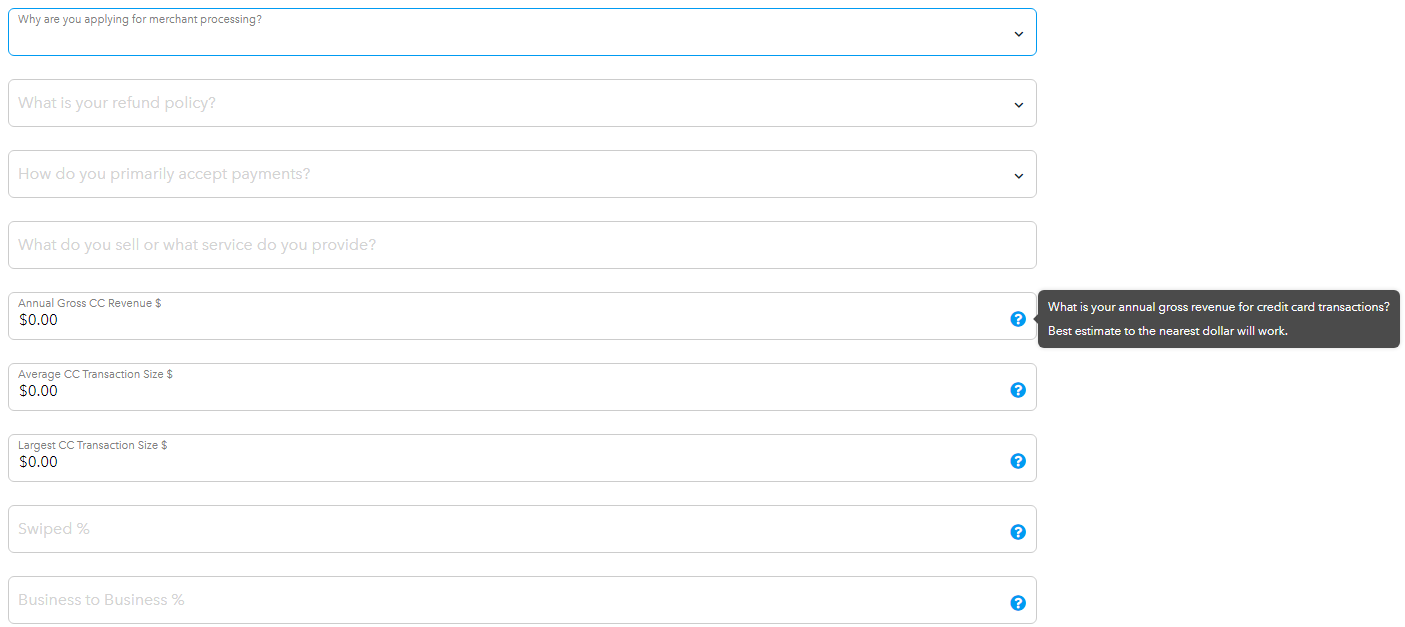

One of the biggest reasons Stripe is so popular is that, as a payment aggregator, you don’t need to open a traditional merchant account to use it. This means you can sign up to Stripe and start processing payments in minutes. Stax, along with most other “traditional” payment processors, requires new merchants go through an underwriting process before they’re accepted. In Stax’s case, this can take up to 2 business days. It sounds tedious, but these measures are in place for a reason. Underwriting is a vital process that helps payment processors reduce the risk of losing money to fraud. By reducing this risk, processors don’t have to make up their losses with sky-high rates. While it’s tempting to go with Stripe for its quick signup process, even a cursory look at its reviews makes it clear why it’s so important to go with a payment processor that verifies its merchants. Almost half of all Stripe reviews are from customers complaining that their payments are on hold, or that their accounts have been closed with no warning. It’s difficult to tell from reviews alone what the underlying reasons for these issues might be. But when you look at Stax’s reviews and find virtually no customers reporting payment holds or account termination, it’s clear that Stripe’s lack of underwriting is causing issues. In short, Stax’s underwriting process means you’ll get a more reliable payment processing service.

Compliance and Security

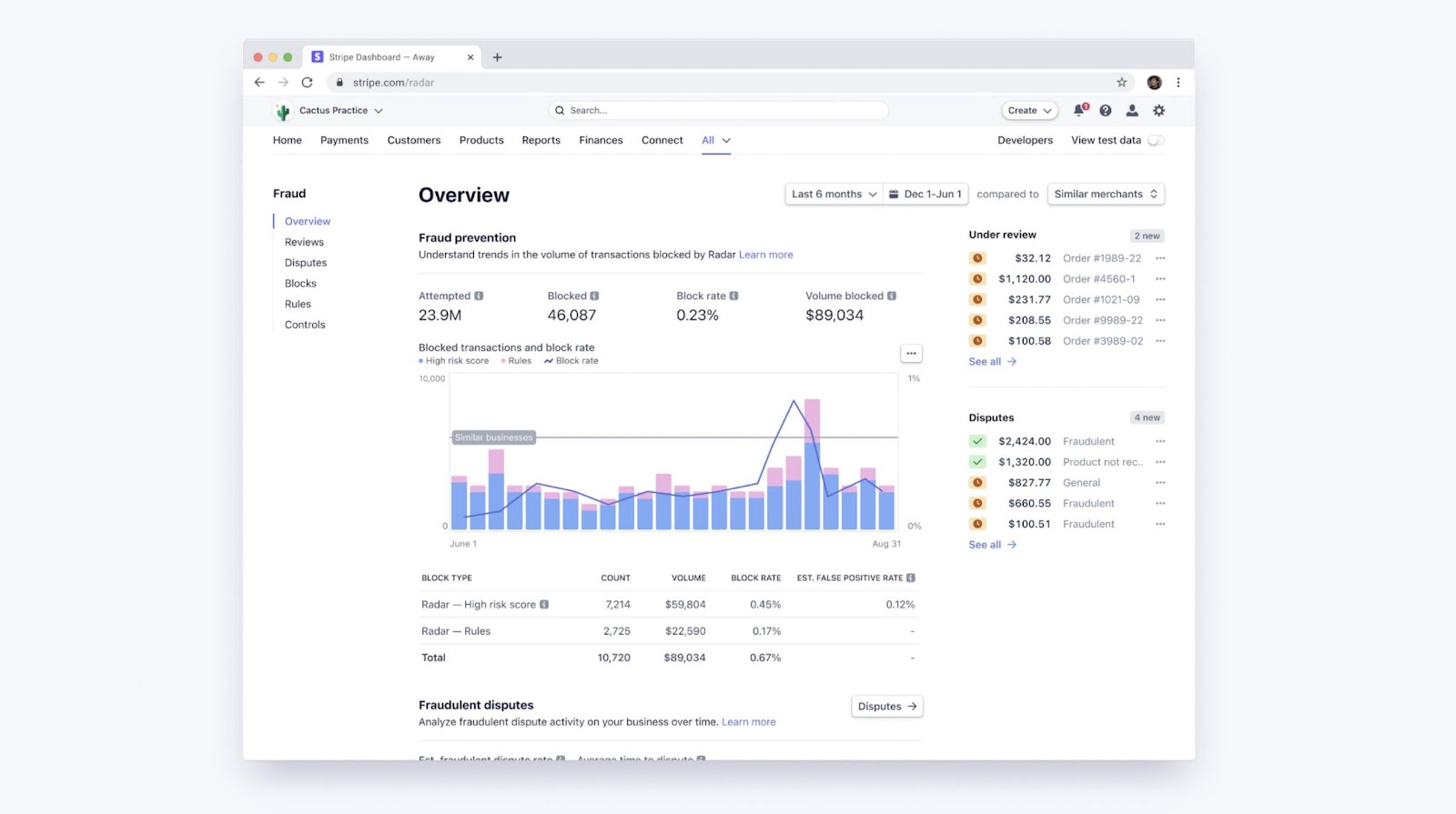

Stripe’s Fraud Detection Software is Second to None

Both Stax and Stripe are PCI Level 1 compliant, which means that they’re both required to undergo annual auditing and quarterly network scans to ensure data security. While Stax offers a good level of PCI compliance support and fraud detection software, it’s nowhere near the same level as Stripe’s offering. Stax and Stripe both have PCI compliance dashboards that will guide you through completing your annual PCI questionnaire. On top of this, Stripe offers pre-filled SAQ A (for e-commerce merchants) and SAQ C (for merchants with one POS device/location), saving you a ton of time. In comparison, Stax only offers a third-party dashboard to help you with PCI compliance. This is still more than most other credit card processors, but it’s not enough to compete with Stripe’s more comprehensive support.

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Pricing

Stax Offers Significant Savings for Most Businesses

When it comes to cost, the main difference between these processors is that Stax has a subscription-style pricing structure, while Stripe uses the more common interchange-plus model. Neither Stax nor Stripe makes you sign a contract or charges early cancellation fees if you decide they’re not for you. On the surface, it’s trickier to compare which processor offers the most financial benefit as both pricing models have their pros and cons for different types of businesses. Stax’s pricing model is great for high-volume businesses, while Stripe’s pricing model typically works better for smaller businesses. In addition, Stax doesn’t disclose all its fees – you’ll have to check the contract you’re asked to sign when you apply. Stripe, on the other hand, discloses all its fees on its website. With that being said, Stax is a lot more budget-friendly than Stripe, and it makes it a lot easier to budget for your payment processing costs. With Stax, you get a choice of three pricing plans – Growth ($99.00), Pro ($139.00), and Ultimate ($199.00). The Growth plan comes with the basic software you need to get started, while the Pro plan adds a card vault, payment links, and more. The Ultimate plan comes with everything the low-tier plans do, plus advanced reporting, automatic card updating, one-click shopping carts, and data exports. On top of the flat monthly fee, you’ll pay a small flat fee of 8¢ + interchange (in-person) per transaction. As with most other processors, you can expect to pay chargeback fees on top of this. If you need a payment processor for one-off payments, or your business only takes a handful of transactions each day, then you’ll be fine with Stripe. Stripe’s interchange-plus pricing model means you only have to pay for the features you use, which is ideal for small businesses that don’t have a large budget. You’ll likely outgrow Stripe quickly, though. It charges 2.9% + 30¢ per transaction, which will start to eat into your profits significantly as your business expands. On the other hand, your Stax monthly fee will stay the same unless you upgrade for more features or start processing over $500,000/year, giving you plenty of room to grow before your fees do. Overall, Stax offers the most value of these two credit card processors. It’s a lot easier to budget for your credit card payments thanks to the (mostly) all-inclusive monthly fee. If you’re regularly processing over $5,000/month, you could save up to 40% on processing fees by using Stax. Here are the key things you need to know in this Stax vs. Stripe comparison.| Stax | Stripe | |

| Monthly fee on the cheapest plan | $99.00 | $0 |

| Transaction fees on the cheapest plan | 8¢ + interchange (in-person) | 2.9% + 30¢ |

| Additional fees |

|

|

| Hardware options |

|

5 proprietary terminal options |

| Payout times |

|

|

| Included software tools |

|

|

| Security features | Fraud detection and prevention tools, account and payment holds | Advanced proprietary fraud detection and prevention tools, account and payment holds |

Support

Don’t Count on a Straight Answer From Stripe

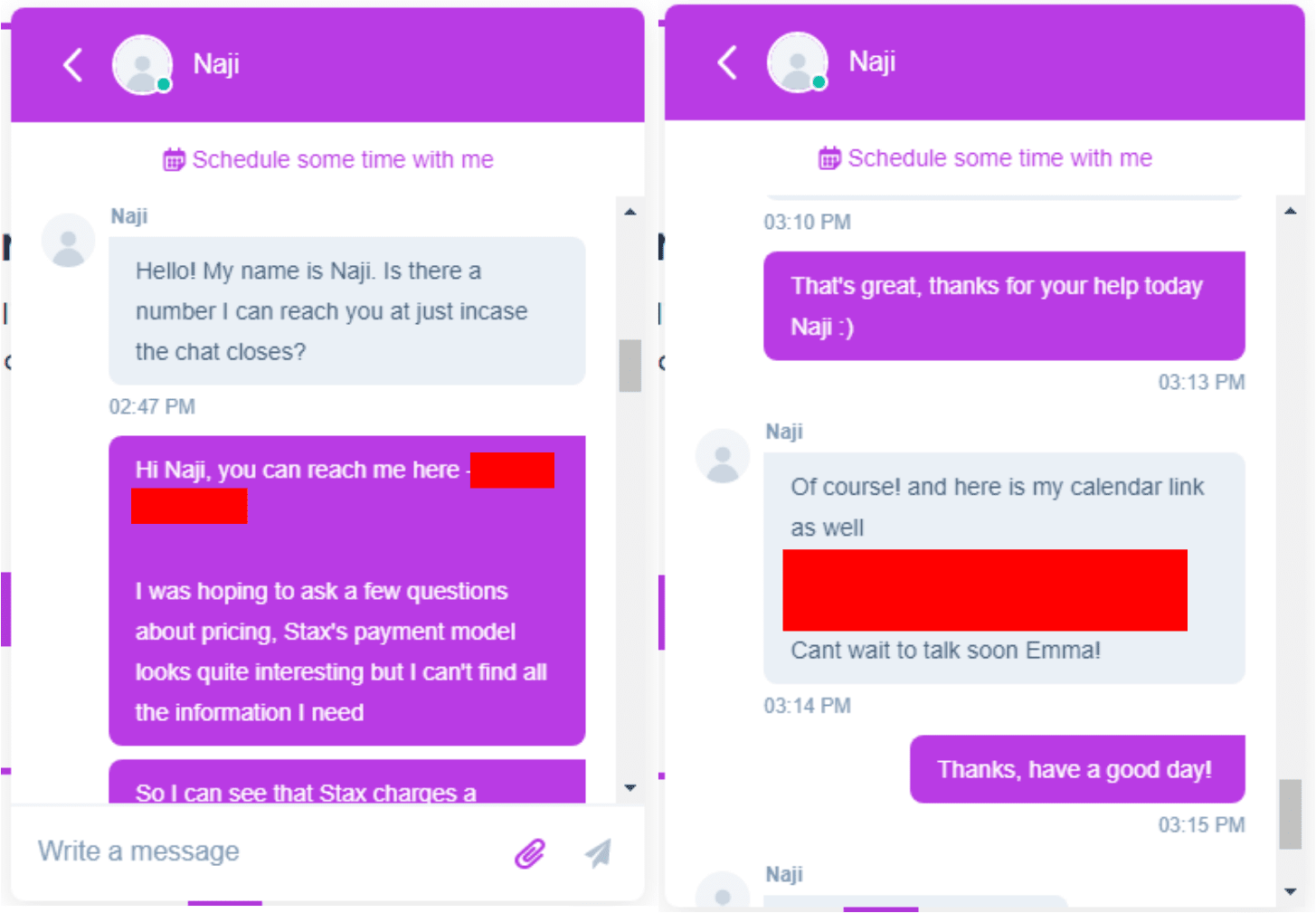

When it comes to quality and the number of channels available, Stax’s customer support wins on both fronts. Both processors provide live chat and email support, along with a fairly comprehensive knowledge base each. Stax, however, offers an additional phone support channel. If you’re using Stripe, you’ll have to initiate a phone call request through your dashboard, which may not be the most convenient option in case of urgent assistance. Stripe states that its customer service team is available 24/7, while Stax doesn’t have any published hours of support. However, that’s not to say that Stax is slow to respond to queries (we tested Stax in our review). When I contacted Stax via live chat, I got an answer within a few minutes, and I received a next-day response to an email query I sent.

Go With Stax to Save Money and Grow Your Business

Thanks to its subscription-style pricing and 0% interchange markup, almost any business will save money with Stax. Not only that, but you’ll get some fantastic software included in your monthly fee, a ton of POS hardware options, and great customer service. I certainly don’t think Stripe is a bad option, though. Its fraud detection and prevention tools, powered by machine learning, are second to none. And despite its high markup and transaction fees, new businesses and those processing only a handful of payments each day will likely find it cheaper than Stax overall. To sum it up, here’s what I found in my Stax vs Stripe comparison.Stax

Stripe

Features

Great software that works with almost any POS device, plus a free terminal on signup

Industry-leading payment software, but only works with five terminals and requires custom programming

Ease of Use

In-depth underwriting process reduces the risk of account holds

Sign up in minutes, but a larger chance of account holds or termination

Compliance

PCI Level 1 processor with fraud detection and prevention tools

PCI Level 1 processor with advanced fraud detection and prevention tools that you can customize with your own rules

Pricing

Subscription-style with low per-transaction fees, software included in monthly price

Interchange-plus with high interchange markup and transaction fees

Support

Live chat, email support, phone, ticket, fax, chatbot, knowledge base

24/7 live chat, email support, phone (via callback request), plus knowledge base and community forum