Know What You Earn

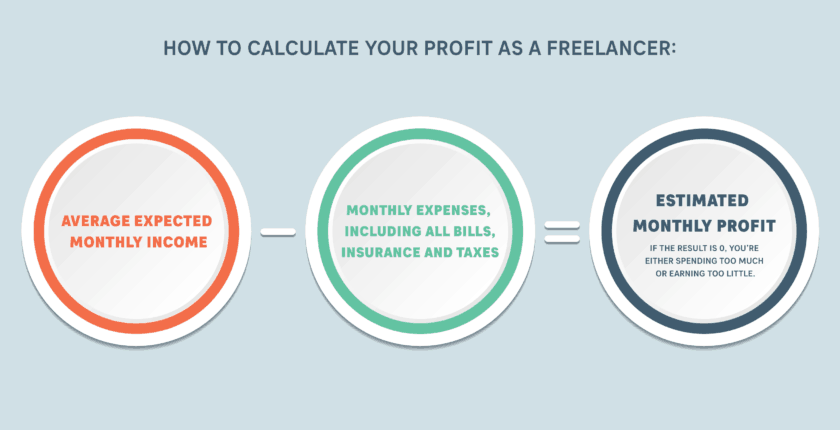

A vital step in managing your finances is to know how much money you’re making. When you’re working as a freelancer, you may not be certain exactly how much money you’re going to earn each month. But you still need to have a good idea of your income, expenses, and profit. Here’s how to calculate your profit as a freelancer:Step #1: Work out your average expected monthly income

- Make a table with two columns.

- One side is for your regular and retainer clients: Note how much you get each month from these clients, add up the amounts and note down the total.

- The other side is for your non-regular clients for the past month: Add up all of the money you’ve earned from these clients.

- If you have a few months of income records, use those to come up with an average monthly income from non-regular clients.

- Take the total earned from non-regular clients and divide it in two, then add it to your regular client income column – this is now your projected monthly income.

Step #2: Add up your expenses

- Create separate lists for your personal and business expenses. Business expenses include your business phone bill, internet costs, electricity bill, and business equipment such as software, computers, etc.

- Also add health insurance to your list of expenses, as well as any pension plan you want to set up for yourself.

- If you prefer not to work from home, consider how much it will cost to rent a space, such as a co-working hub.

- Use your last few months of bank statements to check your expenses. Accounting software like Mint makes this step much easier, as it pulls data directly from your bank and credit card statements to calculate your monthly spend.

Don’t Forget: Taxes! You need to include them on your list of expenses. Don’t overlook them when estimating your budget. (More on taxes below.)

Step #3: Calculate your profit

- Simply subtract your expenses from your income and voila! You’ll have your estimated monthly profit. If the result is zero, you’re either spending too much or earning too little.

It’s a great idea to create separate bank accounts for personal use, business use, and savings. Most banks offer discounts on bank fees when you open multiple accounts. It’s much easier to keep track of your income and different expenses when you separate your money into different accounts.

Don’t Forget to Account for Taxes

One of the biggest burdens for freelancers is paying taxes and other benefits. It’s doubly hard because you don’t have an employer making contributions to your health insurance. It’s so tempting for freelancers to put off paying insurance or to wait for separate money for taxes until the end of the tax year – thereby paving the road to tax hell. It’s important to be responsible for setting aside the right amount each month for these vital payments. Here’s how to make it easier to keep up with your taxes and other responsibilities.- Create a separate account. As well as a personal account and a business account, you can open another account solely for tax and insurance purposes.

- Estimate your tax burden. In many countries, including the U.S., freelancers need to pay self-employment tax as well as income tax. In the U.S., self-employment tax means your Medicare and Social Security contributions (which an employee shares with their employer). These begin at 15.3% on your first $128,400 in 2018 and run at 2.9% over this threshold.

- Separate the money every month. It takes discipline to do this, but you’ll thank yourself come tax season. Most freelancers need to pay around 25% of their income as tax, but it’s best to use one of the many free tax calculators to work out your tax obligation. Every month, deposit a quarter of your income into your tax account.

- Pay your taxes quarterly. Once the money’s left your tax account, you won’t be tempted to raid it to pay for a new laptop. If you pay your taxes quarterly, you won’t face a huge outlay come tax season.

- Automate the process. When you’re employed, the money for taxes leaves your paycheck before it even reaches you. As a freelancer, you can replicate that experience by using Painless1099. Set up your income to go through Painless1099, and it will automatically deduct the amount you need for taxes and send it straight to the IRS for you when payment is due.

Freelancers and Insurance

Another obstacle for freelancers is insurance. Remember, you don’t have an employer making contributions to your health insurance or offering a disability insurance plan. You’ll need to pay it all yourself, and the costs can be high. Still, choosing to skip health insurance and spend the money you save on your healthcare directly can be disastrous. Every freelancer should have health insurance, and it’s up to you to check the requirements in your country of residence.Here are a few tips on managing health insurance as a freelancer in the U.S.:

- If you’re under 26, stay on your parents’ health insurance plan to keep the costs down.

- If you’re in good health generally and don’t have any dependents, a catastrophic health insurance plan could be the lowest cost option. This pays for your healthcare in the event of an emergency but doesn’t give comprehensive cover for checkups, etc.

- Look at your options through Medicare and Medicaid, to see if you qualify for a federal health insurance program.

- Check if you’re eligible for a subsidized health insurance plan through healthcare.gov.

- Consider a Health Savings Account (HSA). This is a savings account that allows you to save pre-tax dollars to spend on medical costs – it also reduces your taxable income.

- Calculate how much you’ll need to pay each year for health insurance, disability insurance, and retirement plans, then divide it by 12. Separate that amount from your monthly income and place it into your tax account.

Freelancers also need to pay for other types of insurance. These can include:

- Life insurance. If you have dependents, life insurance should be non-negotiable.

- Disability insurance. This gives you an income if something happens that prevents you from being able to work, either at your chosen occupation or at any occupation.

- Car insurance.

- Depending on your line of freelancing work, business insurance such as general liability insurance or professional liability might be necessary to protect you from being sued by unhappy customers or people who get injured on your premises.

Freelancer Finances for the Digital Nomad

If you’re a freelancer on-the-go who works from different locations, there are a few more issues you’ll have to bear in mind. Here are four things to consider as a digital nomad:- As well as your ongoing living expenses, you might need to budget for storage for your possessions back home, or for maintenance on a property in your hometown.

- Having an emergency fund and insurance is even more important when you’re a digital nomad, because of the greater risk of experiencing the unexpected, having to manage in a foreign language, and lack of access to healthcare.

- Foreign currency fees can end up taking a significant slice of your income. Think about the best way to convert your money to your local currency – would you save money if you request payment in your local currency, or would you do better to get paid in USD to your home bank account, and then use a no-foreign-transaction-fee credit card as much as possible?

- Pay careful attention to your tax obligations. As a U.S. citizen, you’ll have to complete your tax returns on time, no matter where you are in the world. If you’re working as an independent contractor, you’ll still have to pay your Medicare and Social Security requirements, even if you’re living on the beach in Bali. Depending on where you’re based, you might also have to pay taxes to your current country of residence.

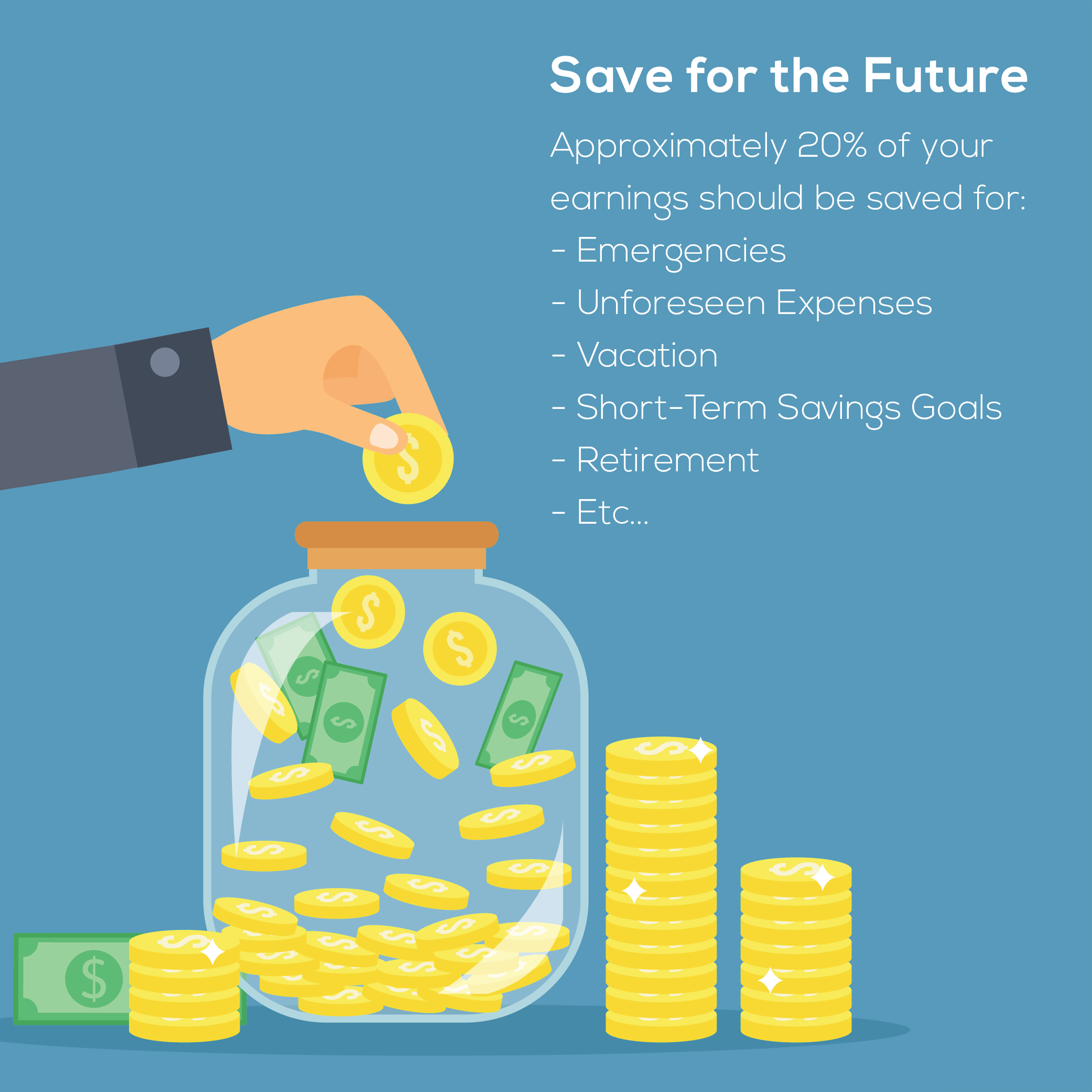

Save for the Future

Savings are vital for a healthy financial life, whether you’re freelancing or earning a salary. First off, you need to save for retirement. It’s another obligation that’s easy to overlook when you don’t have an employer making deductions from your paycheck, but it’s just as important.An estimated 40% of freelancers don’t have an active retirement plan. If you’re one of them, you face the very real possibility of having to keep on working till you drop, which isn’t most people’s idea of fun.

Ideally, you should save around 20% of your income for retirement, but most freelancers save 10%-15% each month. By separating your retirement savings monthly, you’ll reduce the burden, so don’t leave it till the end of the year to make contributions to your retirement plan.

There are plenty of retirement savings plans aimed at freelancers. If you’re in the U.S., Some good options to consider include:

There are plenty of retirement savings plans aimed at freelancers. If you’re in the U.S., Some good options to consider include:- Simplified Employee Pension (SEP)

- Solo 401(k)

- Traditional IRA

- Roth IRA

- Defined benefit plan

To calculate your emergency fund:

- Look through your expenses for the past six months or so.

- Include costs like a mortgage or rental amounts, utility bills, grocery costs, etc., but don’t count luxuries such as vacations.

- Work out the average monthly amount you’ll need to cover these expenses and multiply it by three to six, depending on how many months you want to cover: this is the basis for your emergency fund.

Enjoy Your Profit!

Don’t forget to pay yourself! Once you’ve made your deductions for tax, insurance, savings, and other obligations, and set aside an amount for business expenses, all the rest goes into your personal bank account. Setting up separate accounts showcases the beauty of the process. When the funds arrive in your personal account, you can rest assured that they belong entirely to you. There’s no need to concern yourself with setting aside amounts for taxes or ponder whether saving for the future is necessary.Action Items

- Spend some time calculating your expenses and what you will need income-wise to meet them.

- Don’t forget to include items like taxes and health insurance into your expense plan.

- If you are going to enjoy the digital nomad lifestyle, keep in mind any additional expenses.

- Create a savings plan and make sure it is adequate for your future needs.

- If you are stuck, hire a financial planner to help you organize everything!

Main Page: The Ultimate Guide to Being a Freelancer

Chapter 1: Finding a Freelance Job

Chapter 2: How to Create a Winning Freelance Profile

Chapter 3: How to Price Your Freelance Work

Chapter 4: How to Book a Freelance Job

Chapter 5: How to Discuss a Freelance Project with Your Client Before You Start

Chapter 6: How to Navigate the Freelance – Client Relationship

Chapter 7: How to Manage Your Time as a Freelancer for Maximum Productivity

Chapter 8: How to Get Paid as a Freelancer

YOU ARE HERE – Chapter 9: Managing Your Finances as a Freelancer – A Comprehensive Guide

Chapter 10: How to Advance Your Freelance Career

Chapter 11: How to Be a Freelancer & Keep Your Day Job

Feel free to share this article and/or copy this post or parts of it to your website, blog, or social networks. All we ask is that you attribute it to WebsitePlanet.com