Inside this Article

What We Look For in the Best Card-Not-Present Payment Processing Companies1. Leaders Merchant Services: Lowest CNP Rates for Most Businesses2. Paysafe: Best for Selling High-Ticket Items & Subscriptions Globally3. Stax: Best for High Volumes of Card-Not-Present Payments4. Payment Depot: Diverse Pricing Plans for Small to Mid-Sized Businesses5. Sekure Payment Experts: Best for Growing E-commerce Shops6. POS Pros: Best for Brick-and-Mortar Businesses Venturing Into E-commerceOther Notable Card-Not-Present Payment Processing CompaniesBest Practices for Card-Not-Present-TransactionsGo With One of These Card-Not-Present Payment ProcessorsFAQ

Short on Time? These Are the Best Card-Not-Present Payment Processors in 2024

- Leaders Merchant Services – The lowest card-not-present fees and integration with Authorize.net.

- Paysafe – Discounted access to Authorize.net and international processing in over 120 markets.

- Stax – Lowest CNP transaction fees for high-volume businesses and discounts on Authorize.net.

What We Look For in the Best Card-Not-Present Payment Processing Companies

I prioritized features and benefits crucial for both online-first businesses and those managing in-person and card-not-present transactions. I focused on the following aspects:- Affordable pricing. Card-not-present transactions typically cost more because they carry greater risk, so every service I recommend offers competitive rates and/or cost-saving features.

- Advanced security features. The customer not being present to verify the transaction makes CNP payments more prone to fraud. All card-not-present payment processing services listed here provide robust security features like end-to-end encryption, tokenization, and chargeback management.

- A range of payment methods. Each recommended service supports various payment options, including credit and debit cards and digital wallets. This is essential for reaching a broader customer base. I also selected processors that support international processing.

- Customization and integrations. I only included payment processors that integrate easily with your existing tools and systems. Some of my recommendations have robust APIs that allow for a tailored payment experience, while others integrate with helpful e-commerce and business tools.

- Reliable customer support. Your e-commerce store is open 24/7, so access to round-the-clock support means any issues can be promptly addressed. Most of my recommended processors have 24/7 merchant support.

Our Score

Our Score

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Payment links. You can place payment links across various platforms, including emails and social media, so viewers or recipients can easily pay you. This is ideal for bringing more visibility to your online store or even selling without a dedicated website.

- Simple checkout. With Authorize.net, you can add ‘Buy Now’ buttons to your site to direct customers to a simplified checkout. This solution is excellent for specialty merchants selling one item at a time, charities looking to fundraise online, or small stores with limited inventories.

- High-risk merchant accounts. With an impressive 98% approval rate, LMS caters to merchants from high-risk sectors, new businesses, and those with poor credit.

- Chargeback and fraud assistance. LMS boasts one of the most extensive chargeback and fraud management departments in the industry, offering you expert guidance and support in navigating the challenges that come with CNP transactions.

| CNP solutions |

|

| Security features |

|

| Supported payment methods |

|

| CNP transaction fees on cheapest plan | ~2.9% + 30¢ |

| Monthly fee on cheapest plan | $9.00 |

Our Score

Our Score

Top Global Payment Processor With Industry-Specific Merchant Accounts

Monthly Fee:

$7.95

Transaction Fee:

From 0.50% + $0.10

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- 250+ payment methods. Paysafe supports the widest array of card-not-present payment options beyond the standard credit and debit cards and digital wallets. This includes EFT, online cash, and local payment methods like Boleto and ePay, making it easy to cater to a broad customer base.

- Robust API. Paysafe’s comprehensive API means your website can easily integrate with digital wallets, value-added services, and more. It also integrates with Authorize.net, providing extensive options for customizing your card-not-present payment experience.

- Chargeback program. Paysafe offers the Encytro program for chargeback management. For a flat monthly fee of $29.95, you can get reimbursements of up to $250 per qualified chargeback.

- Advanced security features. Paysafe has a dedicated risk management team that uses advanced technologies designed to prevent fraud, especially for card-not-present transactions. For an additional fee, Paysafe offers the Enhanced Security Package, which acts as an insurance policy in case customer information is compromised.

| CNP solutions | Authorize.net |

| Security features |

|

| Supported payment methods |

|

| CNP transaction fees on cheapest plan | 0.99% + 25¢ (debit cards) |

| Monthly fee on cheapest plan | $16.00 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Free surcharging capabilities. Thanks to its subsidiary CardX, Stax includes a surcharging program in its monthly subscription. This means you can seamlessly pass credit card fees to customers to preserve profit margins while CardX ensures compliance with state and card brand rules.

- Stax Bill. This is the processor’s solution for automating and streamlining subscription billing and payments. Benefits include a flexible product catalog, automated payment recovery, and a customer self-service portal, among other features. It can reduce the time you spend on repetitive tasks by up to 80%.

- Built-in business management. Stax’s comprehensive software allows access to transaction history, customer management, reports, and more for efficient business management. Additionally, Stax’s free mobile app enables on-the-go management.

- Business software integrations. Stax integrates with various business solutions, including QuickBooks for accounting, Salesforce for customer relationship management (CRM), and Mailchimp for email and marketing automation via Zapier.

| CNP solutions |

|

| Security features |

|

| Supported payment methods |

|

| CNP transaction fees on cheapest plan | 15¢ + interchange (online) |

| Monthly fee on cheapest plan | $99.00 |

Our Score

Our Score

Excellent Customer Service Backed by a Dedicated Risk Monitoring Team

Monthly Fee:

From $79

Transaction Fee:

From 0% + 10¢

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Shopping cart options. Payment Depot’s pre-built shopping cart template lets you start selling immediately. It also integrates with popular third-party solutions like 3dcart, OpenCart, and ZenCart. Alternatively, you can use Payment Depot’s extensive API to build custom shopping carts for your websites or mobile apps.

- E-commerce integrations. Payment Depot integrates with popular e-commerce platforms like WooCommerce, BigCommerce, Magento, Shopify, and PrestaShop, so you can accept payments with the platform of your choice.

- 24/7 risk monitoring team. Payment Depot’s risk monitoring team helps you mitigate the risk of chargebacks and fraud, and it takes a preventative stance by monitoring banking policy changes and the latest fraud methods.

- Easy chargeback management. You can manage your chargebacks directly from your account dashboard. This feature centralizes all necessary information, saving you time.

| CNP solutions |

|

| Security features |

|

| Supported payment methods |

|

| CNP transaction fees on cheapest plan | 0.2%-1.95% |

| Monthly fee on cheapest plan | N/A |

Our Score

Our Score

Save up to 100% on Your Processing Costs With the Edge Program

Monthly Fee:

From $0

Transaction Fee:

From 0%

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- One-click checkout. You can attach “Buy Now” buttons across your website, social media, emails, and other places. Your customers can complete transactions with a single click, which removes friction and increases sales.

- Breach forgiveness. Breach forgiveness. Sekure’s PCI Plus program includes breach forgiveness of up to $100,000 for businesses classified as PCI Level 3 or 4. If your business suffers a data breach, you won’t need to reimburse any expenses unless the costs exceed $100,000.

- No PCI fees. Your business automatically becomes PCI compliant by utilizing Sekure’s free Payanywhere equipment. Sekure also has the PCI Plus program, free for some merchants, that handles PCI compliance, including handling PCI fees.

- Fast funding. Sekure Payment Experts offers free same- or next-day funding, a service that usually costs extra with other processors.

| CNP solutions |

|

| Security features |

|

| Supported payment methods |

|

| CNP transaction fees on cheapest plan | 2.99% + 19¢ (in-person & online) |

| Monthly fee on cheapest plan | N/A |

Our Score

Our Score

Specialized Point-of-Sale Solutions for In-Person and Online Sales

Monthly Fee:

From $5

Transaction Fee:

From 0.30% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Integrations. POS Pros seamlessly integrates with popular e-commerce and business software solutions like WooCommerce, Shopify, QuickBooks, and FreshBooks through Authorize.net.

- Free POS equipment. You can choose from free Dejavoo Z11, Clover Mini, or Clover Flex terminals. This allows you to equip your business with the necessary technology for processing in-person transactions without additional investment.

- 24/7 technical support. CNP transactions often occur outside of regular business hours. POS Pros provides around-the-clock support, ensuring you receive help whenever necessary.

- No contracts or cancellation fees. You’re not locked into long-term contracts, making it easier to adjust your payment processing needs without financial penalties.

| CNP solutions |

|

| Security features |

|

| Supported payment methods |

|

| CNP transaction fees on cheapest plan | 1.95% (online) |

| Monthly fee on cheapest plan | $5.00 |

Other Notable Card-Not-Present Payment Processing Companies

7. Chase Payment Solutions

Our Score

Our Score

Favorable Flat Rate Pricing & E-Commerce Features for SMEs

Monthly Fee:

$0

Transaction Fee:

From 2.6% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

8. Square

Our Score

Our Score

Advanced E-Commerce and Security Solutions for Start-Ups

Monthly Fee:

From $0

Transaction Fee:

From 2.5% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

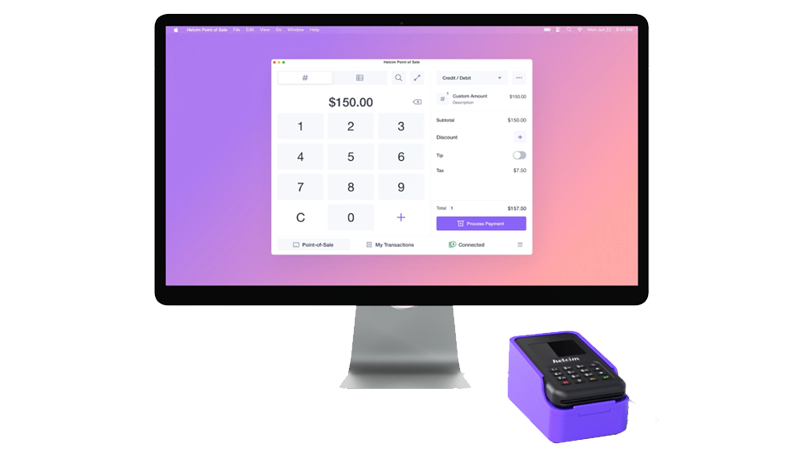

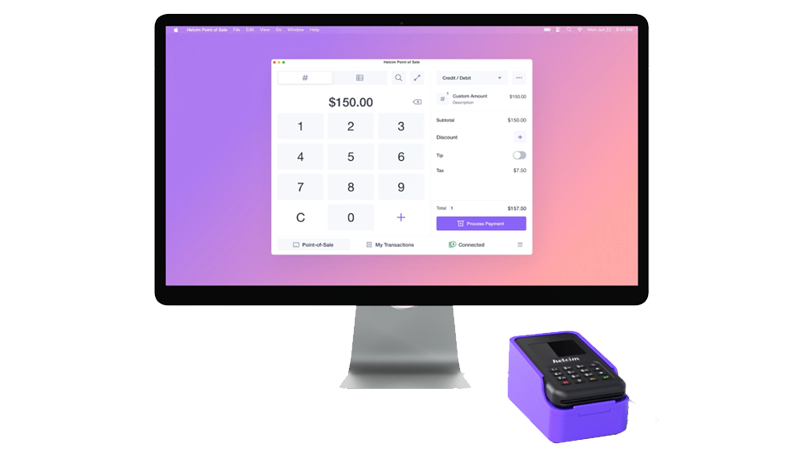

9. Helcim

Our Score

Our Score

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Best Practices for Card-Not-Present-Transactions

Here are a few things to keep in mind if you process many CNP transactions:- Comply with PCI Security Standards. To safeguard customer data, your payment processing system needs to adhere to the Payment Card Industry Data Security Standard. Choose a processor that either provides PCI compliance by default or helps you achieve and maintain it.

- Prioritize Security. Partner with a processor that offers robust security features, such as Address Verification Service (AVS), Card Verification Value (CVV) checks, tokenization, end-to-end encryption, and dedicated fraud monitoring.

- Handle customer data responsibly. Never write down sensitive information such as card numbers or request these details through text or email. To prevent data leaks and build customer trust, ensure everyone on your team is well-trained in handling customer data responsibly.

- Avoid chargebacks. Chargebacks can be costly and damaging to your reputation. Try to find a payment processor with strong chargeback resources. Additionally, maintain unambiguous refund and cancellation policies, have accurate product descriptions, use a clear billing descriptor on customer statements, and keep proof of customer participation.

Go With One of These Card-Not-Present Payment Processors

Selecting the right credit card processor is critical for businesses operating online or in other card-not-present environments. Here are my top recommendations. If you want to negotiate the lowest CNP rates and create a plan based on your specific needs, I recommend Leaders Merchant Services. It integrates seamlessly with the trusted Authorize.net payment gateway and virtual terminal. Plus, it works with all business types, including high-risk ones, and has one of the largest chargeback and fraud management teams. Go with Stax if you handle high volumes of card-not-present transactions. Its subscription-based payment model with low transaction fees can save you up to 40% compared to traditional interchange-plus processors. This fee covers CNP solutions like shopping cart setup, invoicing, and more. You also get discounted access to Authorize.net. Or, if you sell high-value items globally, use Paysafe. It has below-average transaction fees, and its support for international processing makes it easy to expand into new markets. It’s also a great option for businesses that sell subscriptions and offers Authorize.net at a reduced cost.Here is a short comparison of the best card-not-present payment processing companies.

| Best Feature | Best For | Monthly fee on cheapest plan | Transaction fees on cheapest plan | ||

| Leaders Merchant Services | Low, negotiable rates, payment links to sell online everywhere | All types of businesses, including high-risk merchants, looking to save on CNP payment processing | $9.00 | ~2.9% + 30¢ | |

| Paysafe | Discounted access to Authorize.net, advanced subscription management | Businesses selling high-value items and subscriptions globally | $16.00 | 0.99% + 25¢ (debit cards) | |

| Stax | Subscription-based pricing model with low CNP transaction fees | Businesses processing a high volume of CNP transactions | 8¢ + interchange (in-person) | 15¢ + interchange (online) | |

| Payment Depot | Versatile pricing accommodating any card volume and free virtual terminal | Businesses processing any card volume | N/A | 0.2%-1.95% | |

| Sekure Payment Experts | Integrations with many payment gateways and an extensive e-commerce partner network | Growing online businesses that need a payment solution that can follow their changing needs | N/A | 2.99% + 19¢ (in-person & online) | |

| POS Pros | Authorize.net available for a fraction of its original price (or for free) and extensive POS selection | Brick-and-mortar businesses venturing into e-commerce | $5.00 | 1.95% (online) |